Climate Change Response and Management

Overview of Climate-Related Financial Information Disclosure

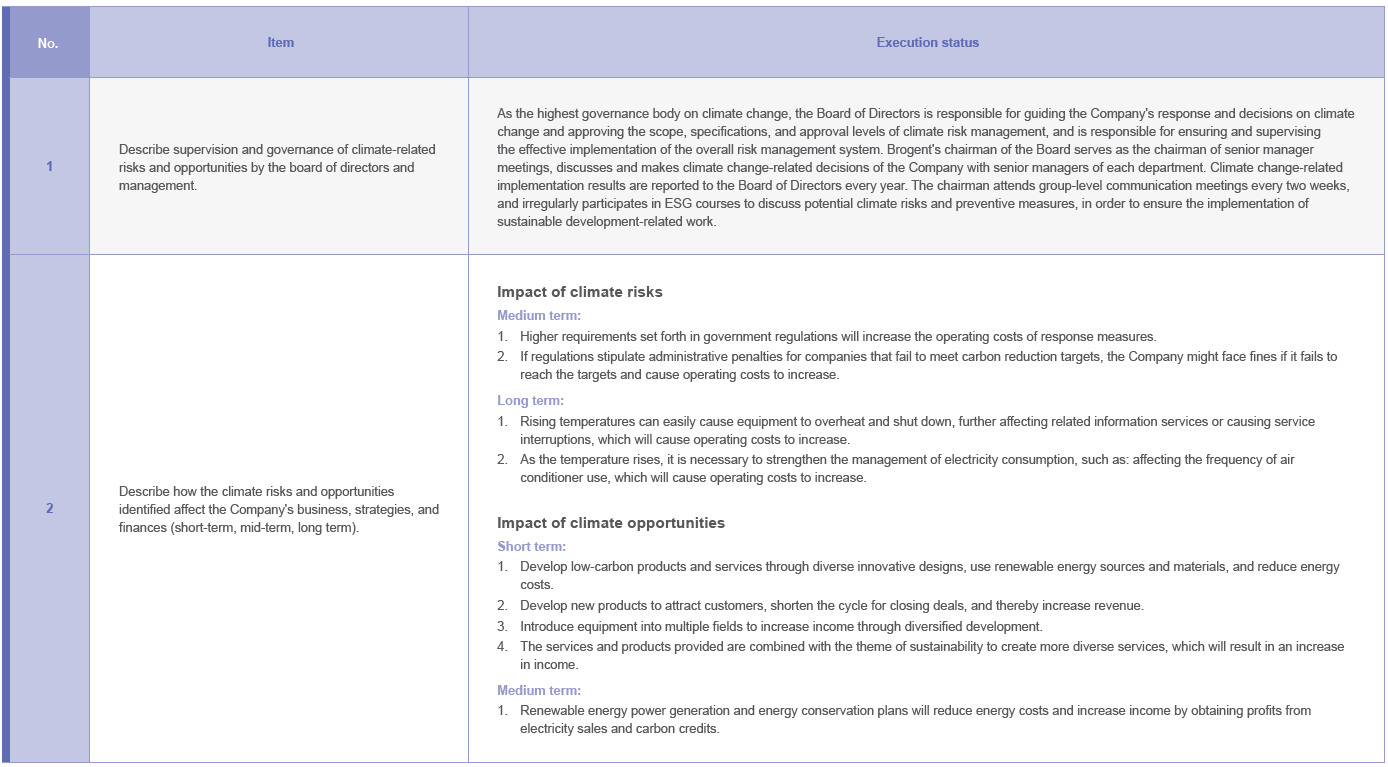

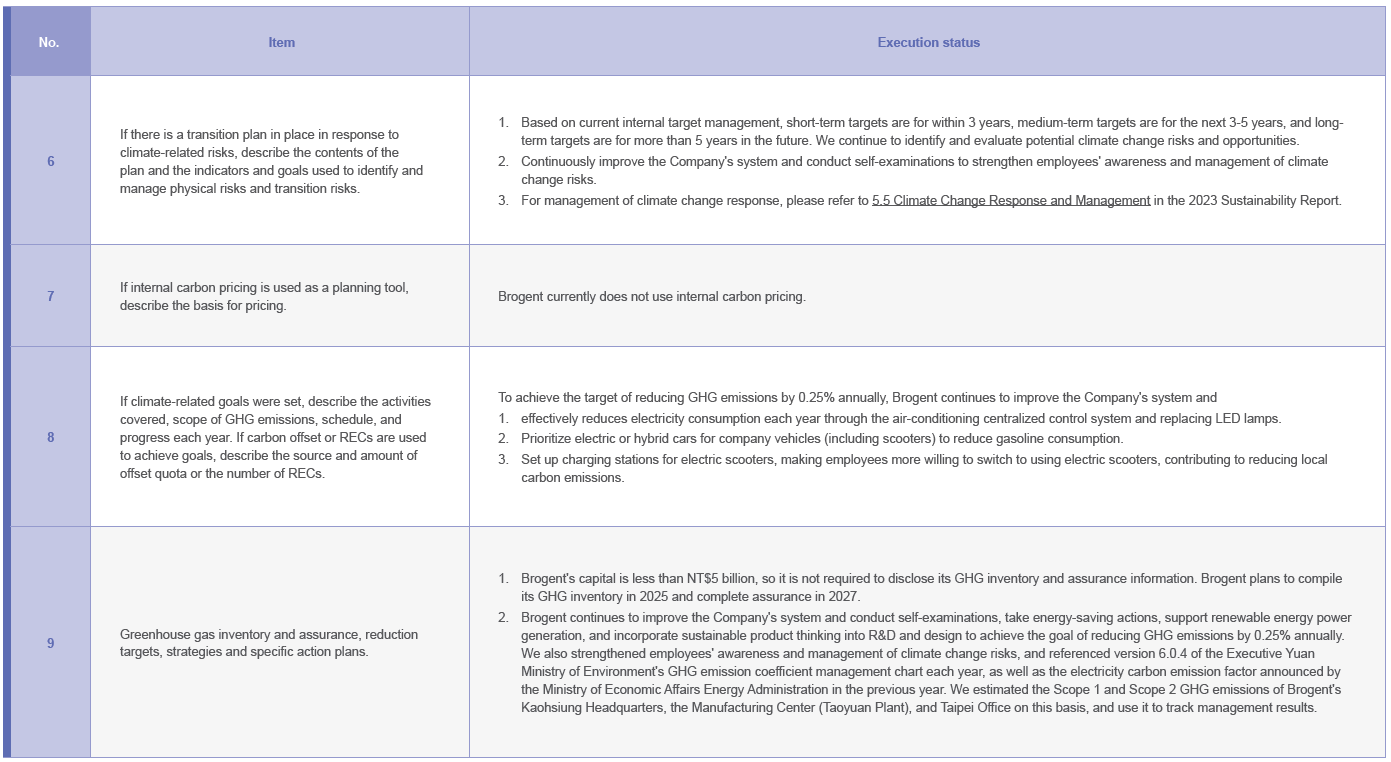

In light of potential financial risks to business operations due to climate change, disclosing information related to climate change has become relevant in sustainability information disclosure. Brogent has set the target to reduce GHG emissions by 0.25% each year, and identified climate-related risks and opportunities in accordance with the Task Force on Climate-related Financial Disclosures (TCFD) issued by the Financial Stability Board (FSB) and the Taiwan Stock Exchange Corporation Rules Governing the Preparation and Filing of Sustainability Reports by TWSE Listed Companies. Identification results are incorporated into the Company's overall risk management framework and serve as one of Brogent's sustainable development strategies.

Identification Process for Climate-related Risks and Opportunities

Brogent continues to pay attention to climate-related policies and action plans of various industries in Taiwan and overseas, and reviews and evaluates various risks and opportunities that may be caused by climate change for matrix analysis, including: direct or indirect physical effects of changes in rainfall and climate patterns; changes in market demand caused by new policies and regulations; risks and opportunities brought by social aspects to the Company's business activities. These efforts aim to reduce climate change risks, seize business opportunities, and implement the Company's sustainability philosophy.

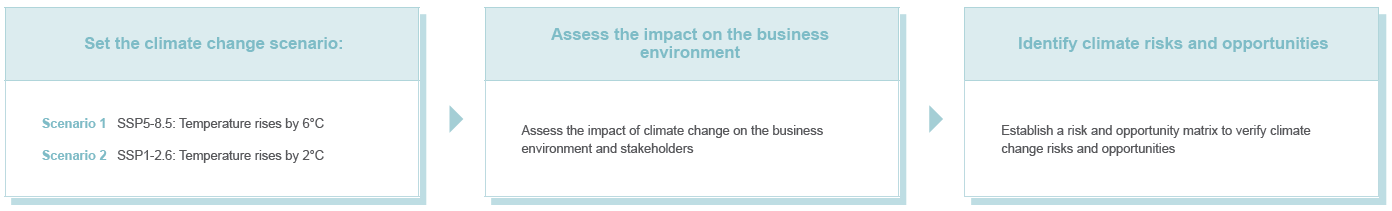

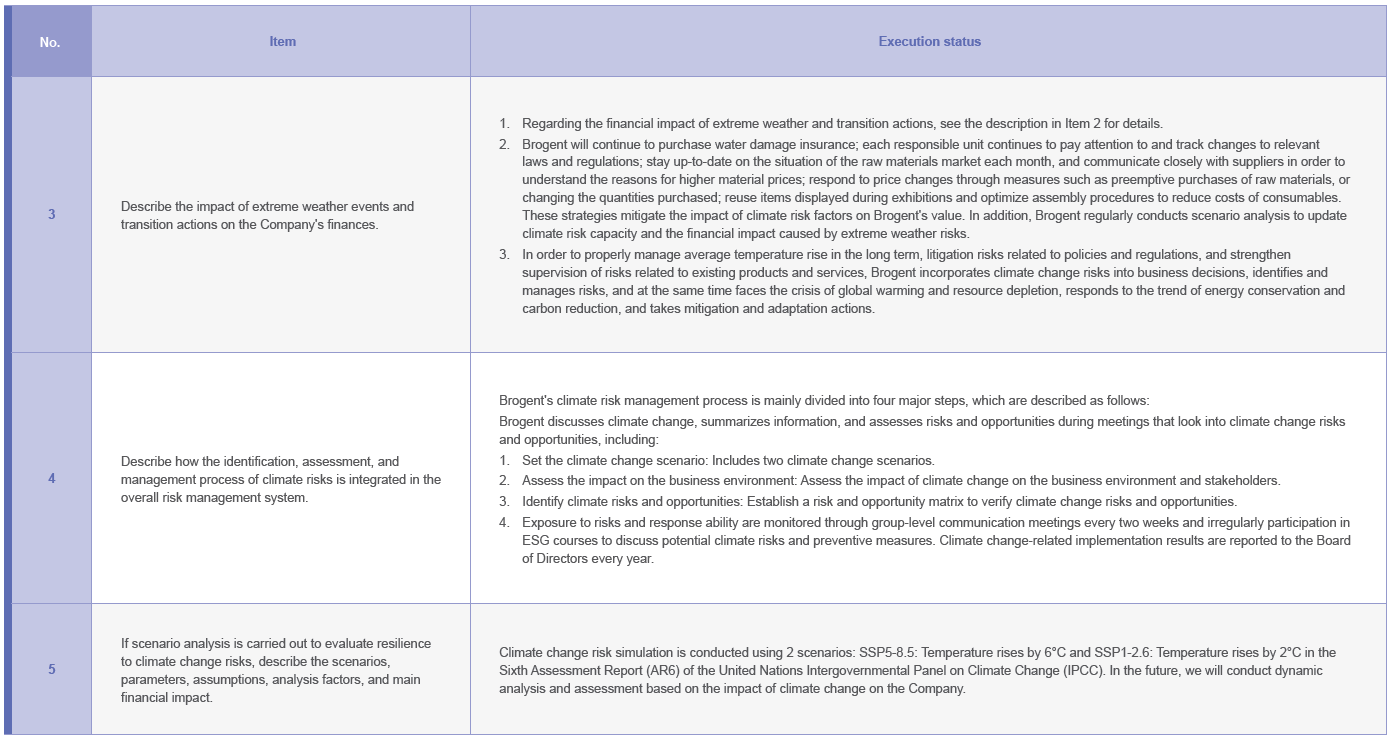

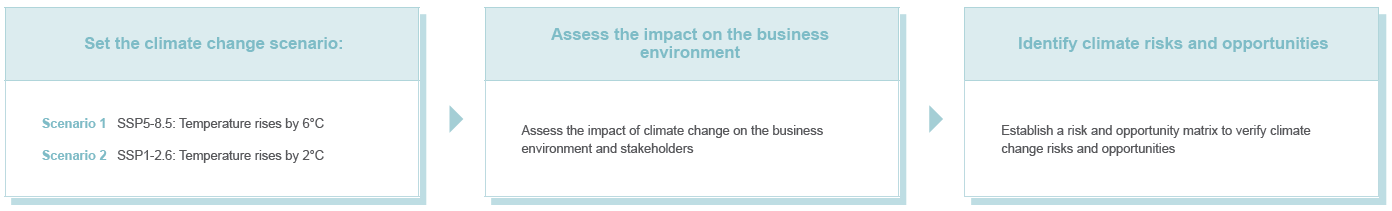

Brogent discusses climate change, summarizes information, and assesses risks and opportunities during meetings that look into climate change risks and opportunities. The specific process for identifying climate change-related risks and opportunities is as follows:

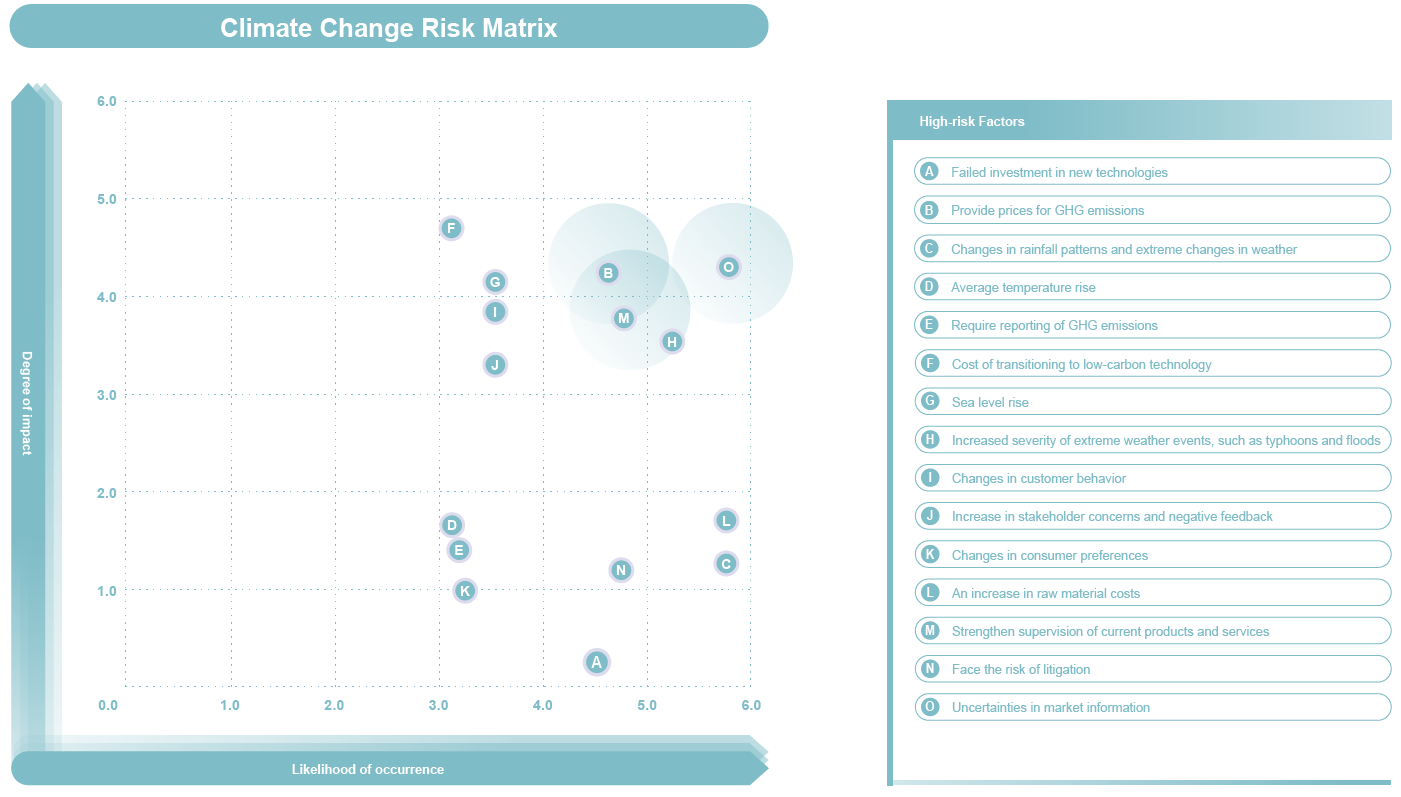

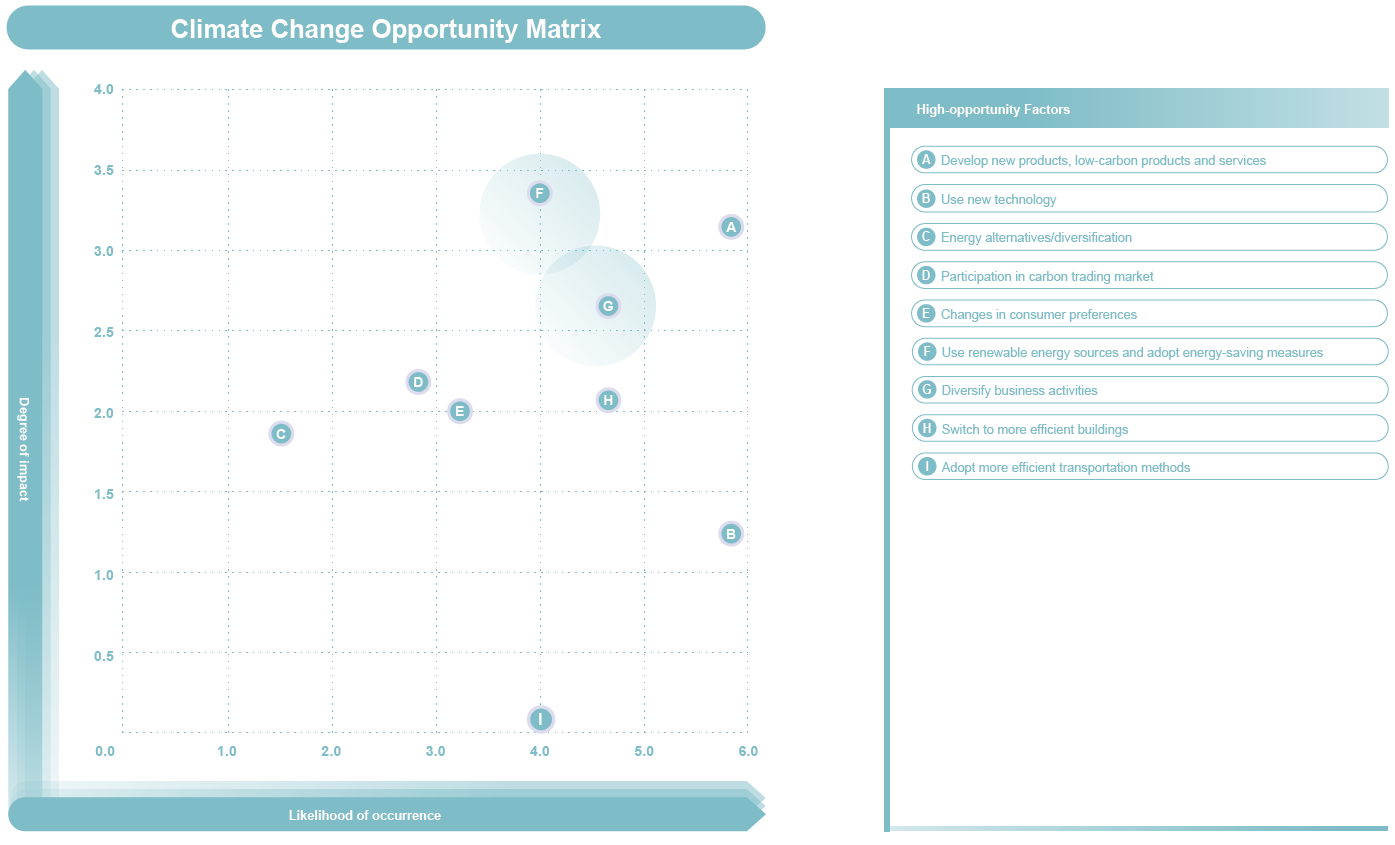

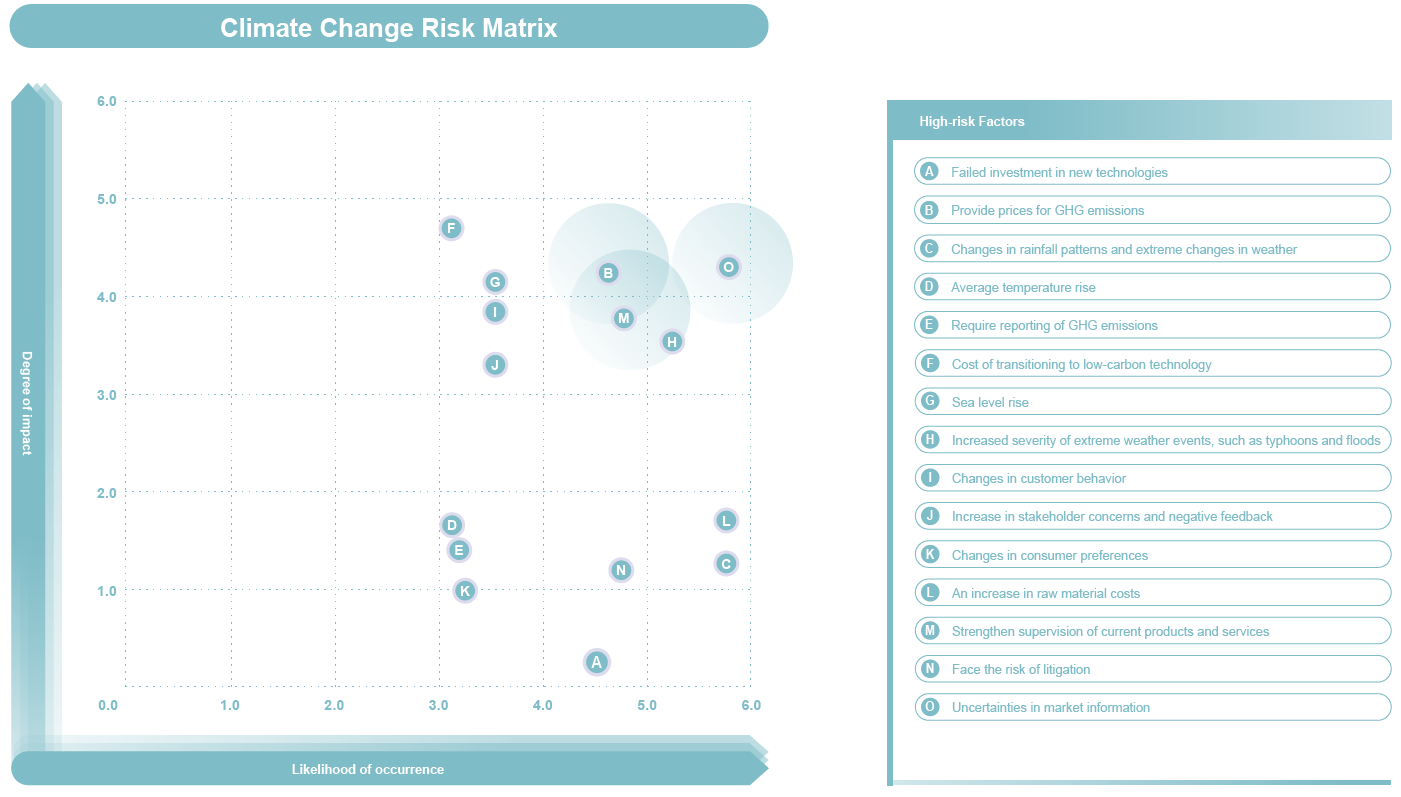

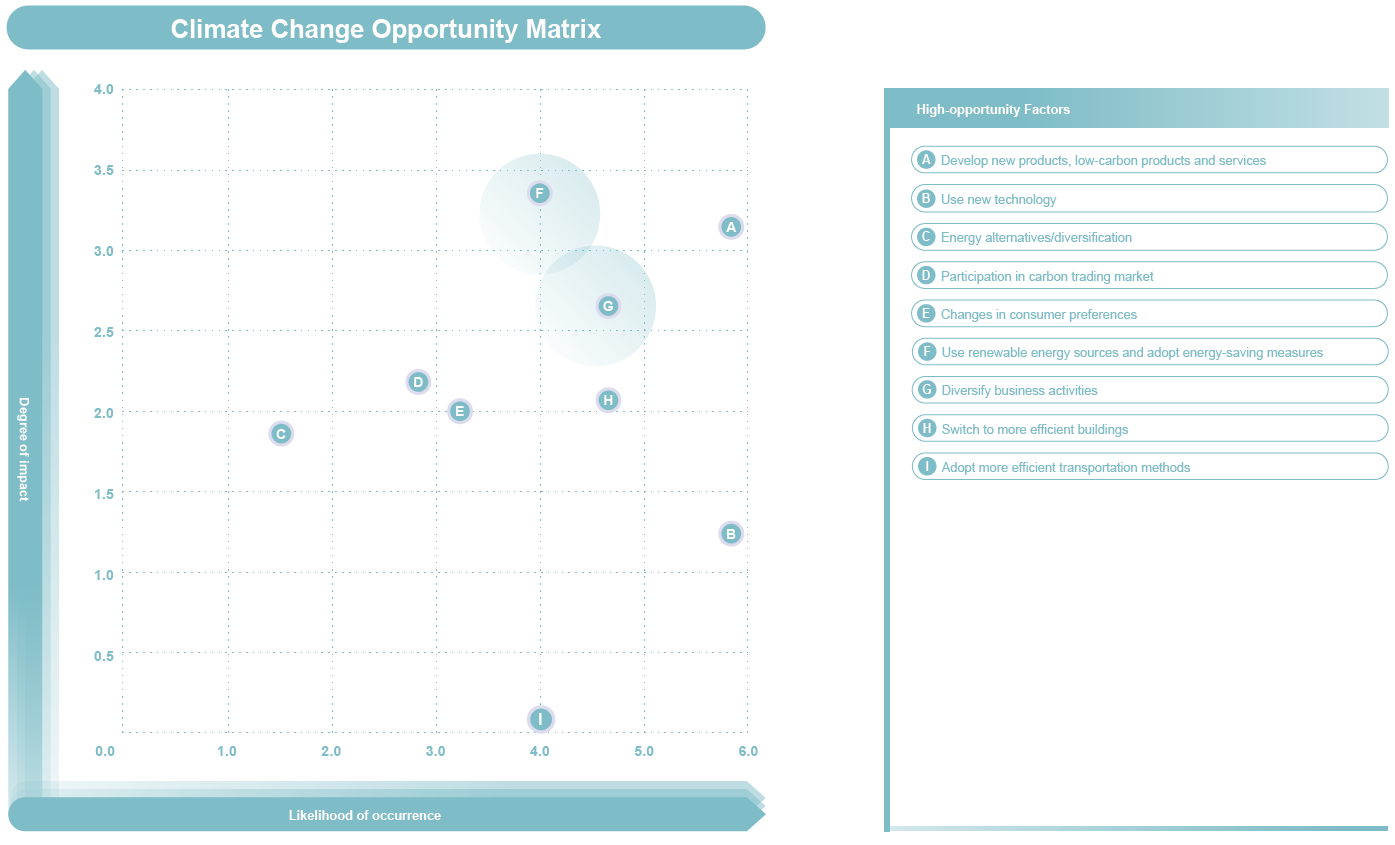

After completing the identification of climate risks and opportunities, we identified three high-risk factors and three high-opportunity factors of Brogent in 2023 based on the "probability of occurrence" and "degree of impact" of the risks or opportunities. Brogent's climate change risk matrix and opportunity matrix in 2023 are as follows:

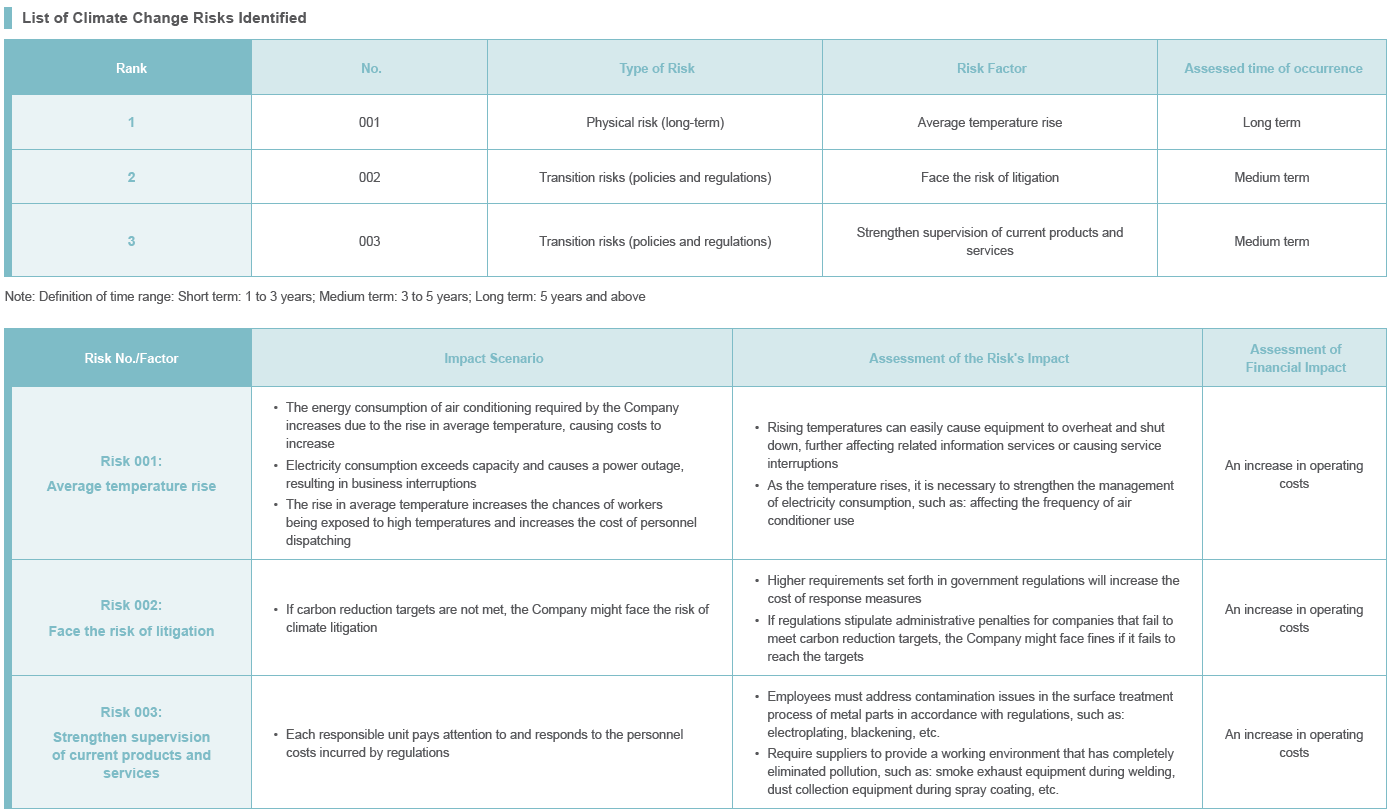

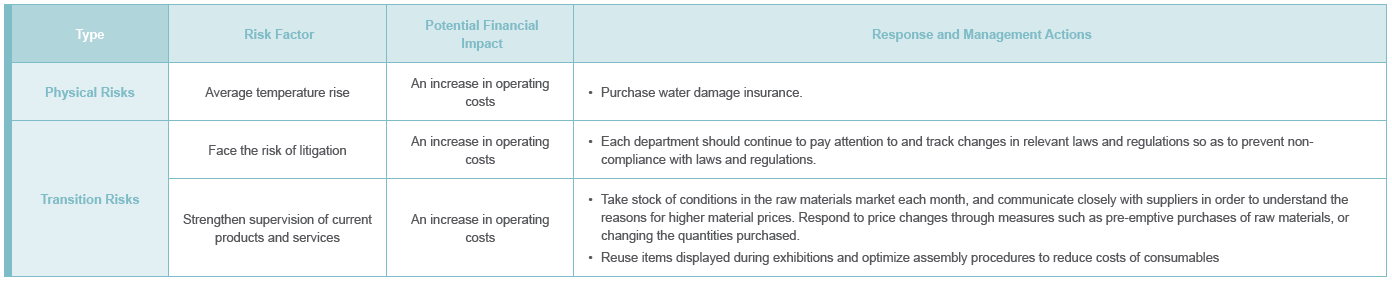

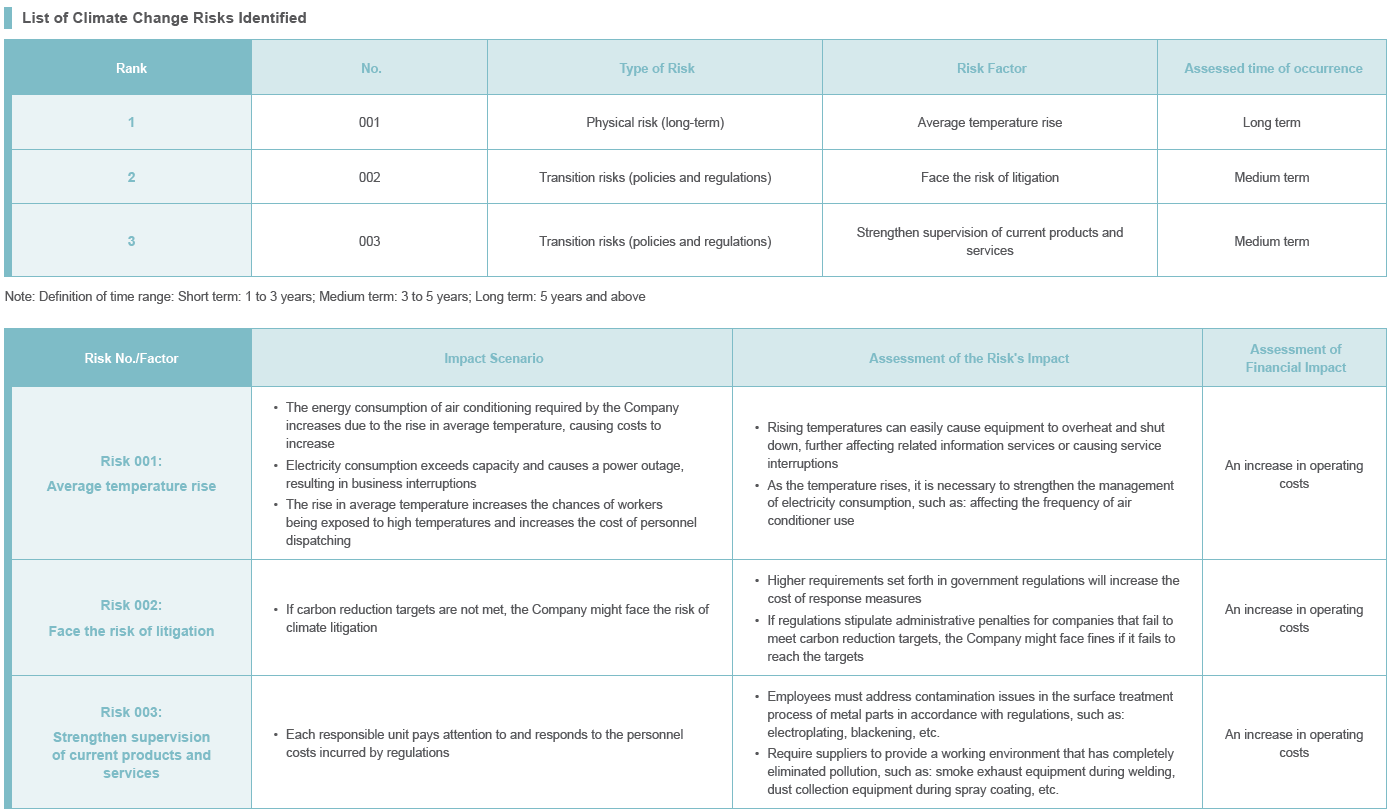

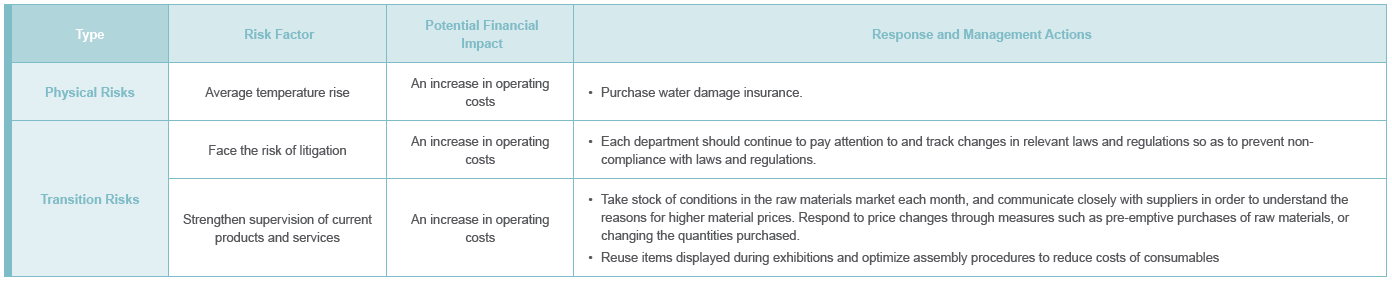

Description of Climate Change-related Risks

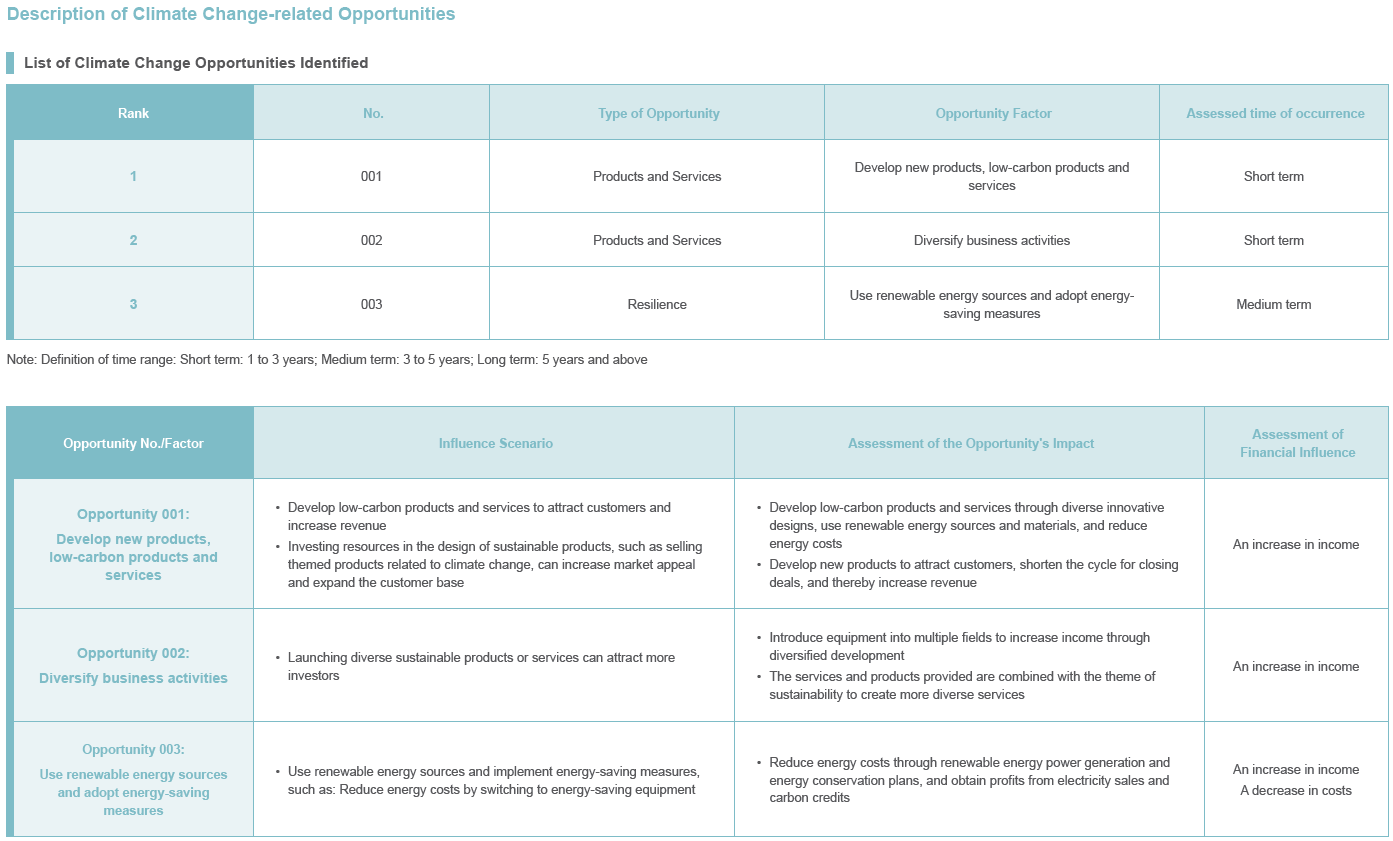

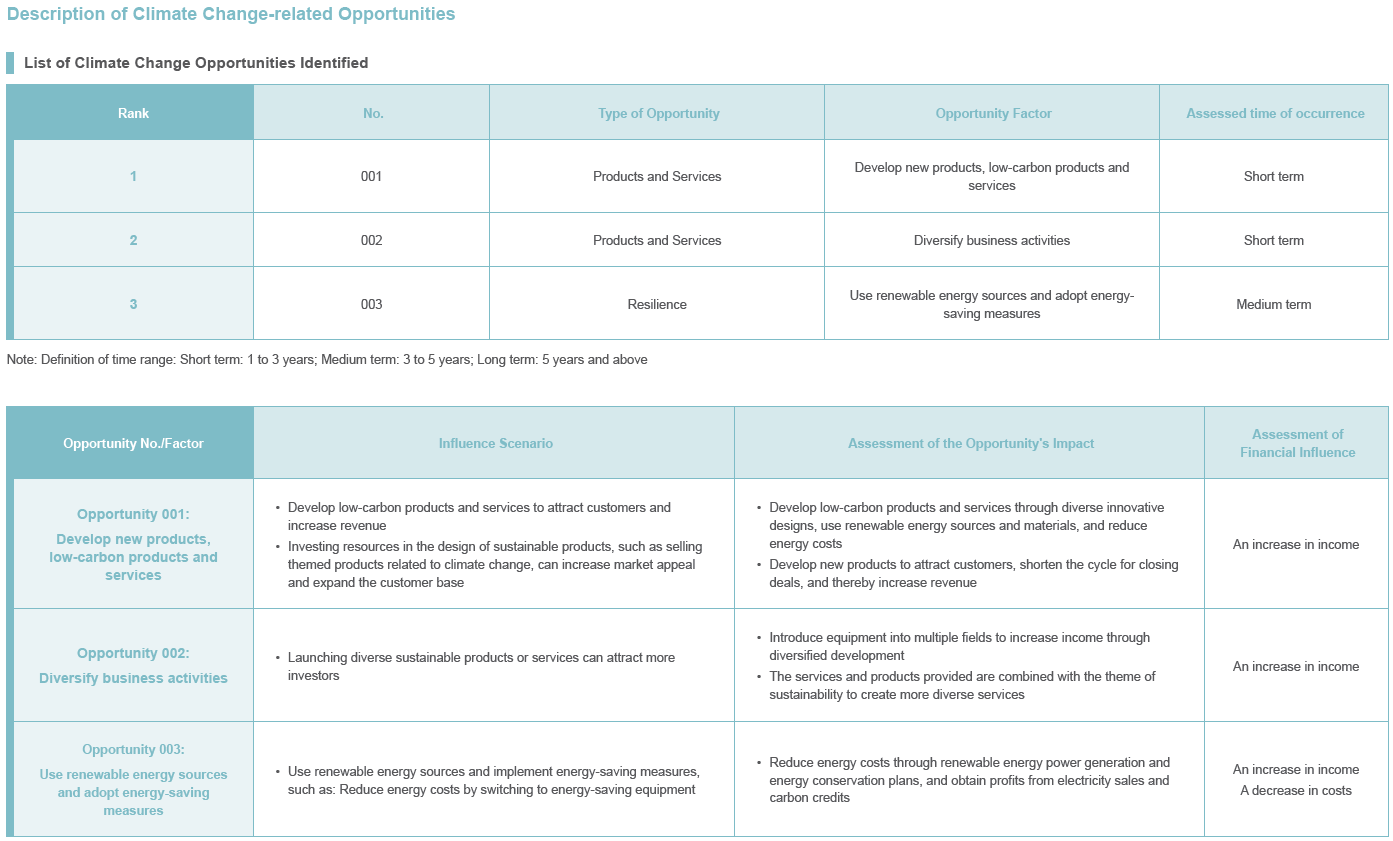

Description of Climate Change-related Opportunities

Response to and Management of Climate Change Risks

Integrate into regular risk management operations, establish specific improvement plans and risk indicators for each risk management item, preventing potential risks from posing a substantial or transitional impact to Brogent should they occur.

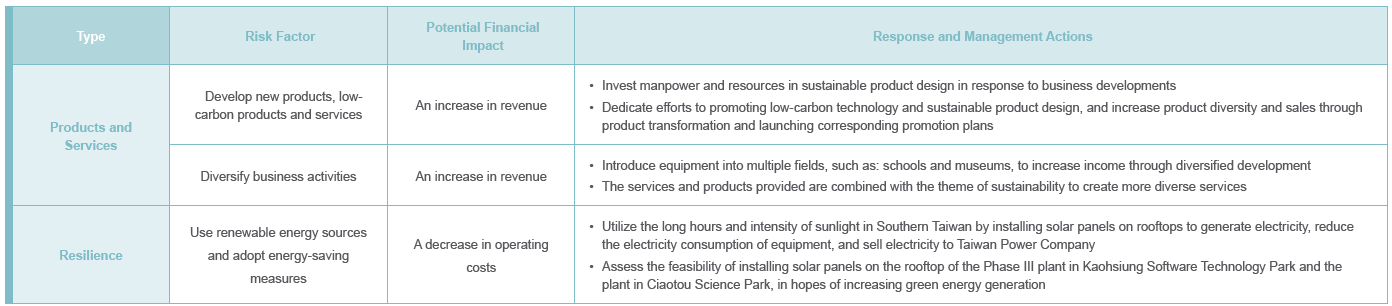

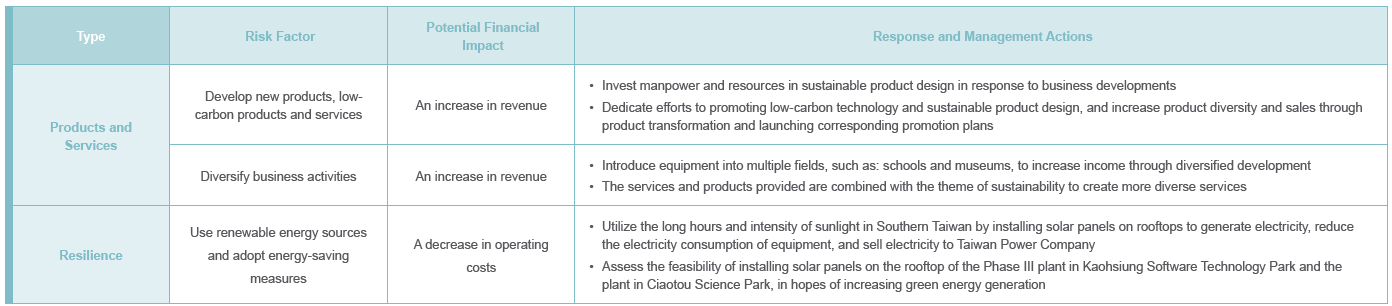

Response to and Management of Climate Change Opportunities

Identify opportunities that can allow Brogent to get ahead of the competition, helping us prepare the necessary investment or resource usage in advance to take advantage of these opportunities.

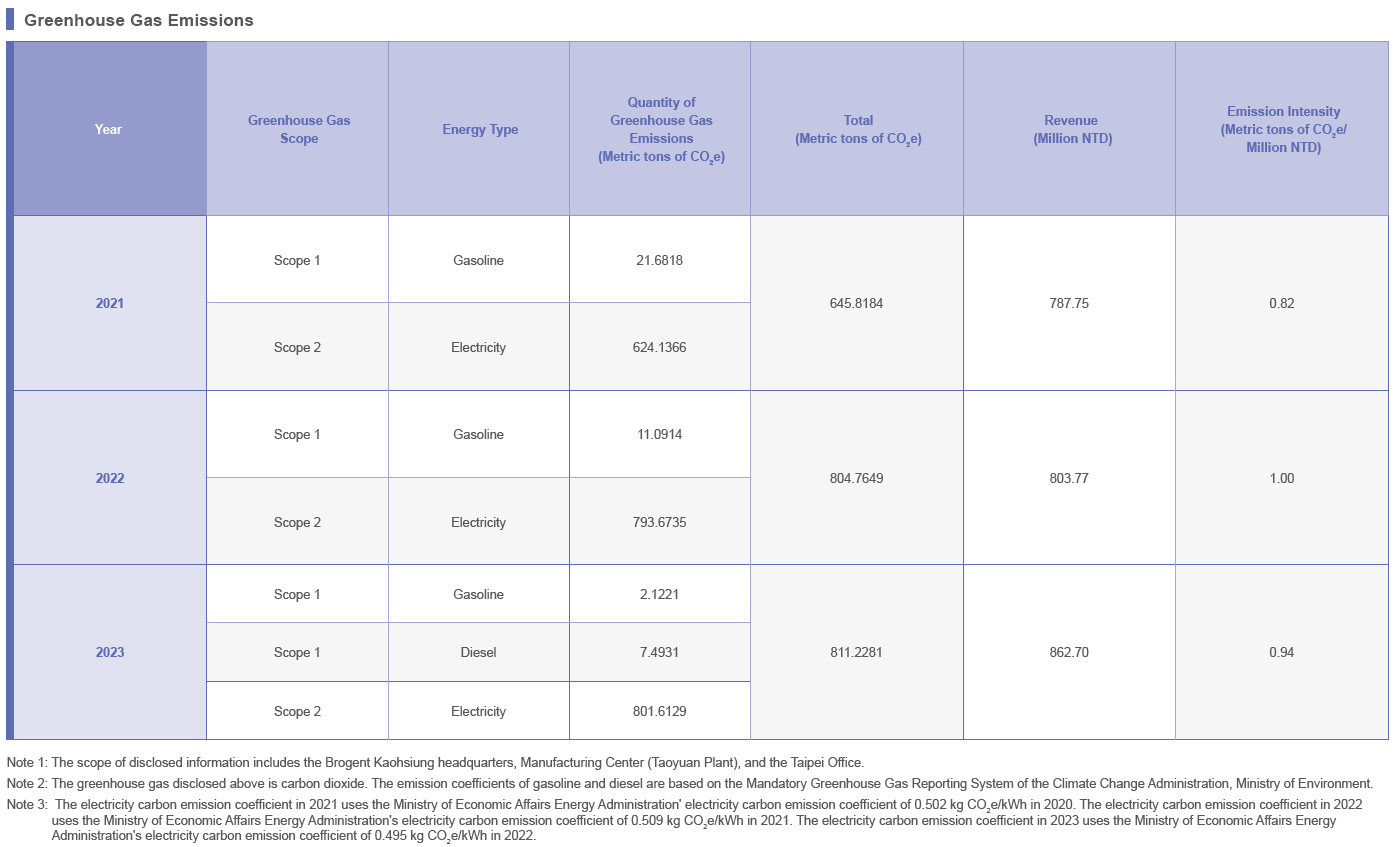

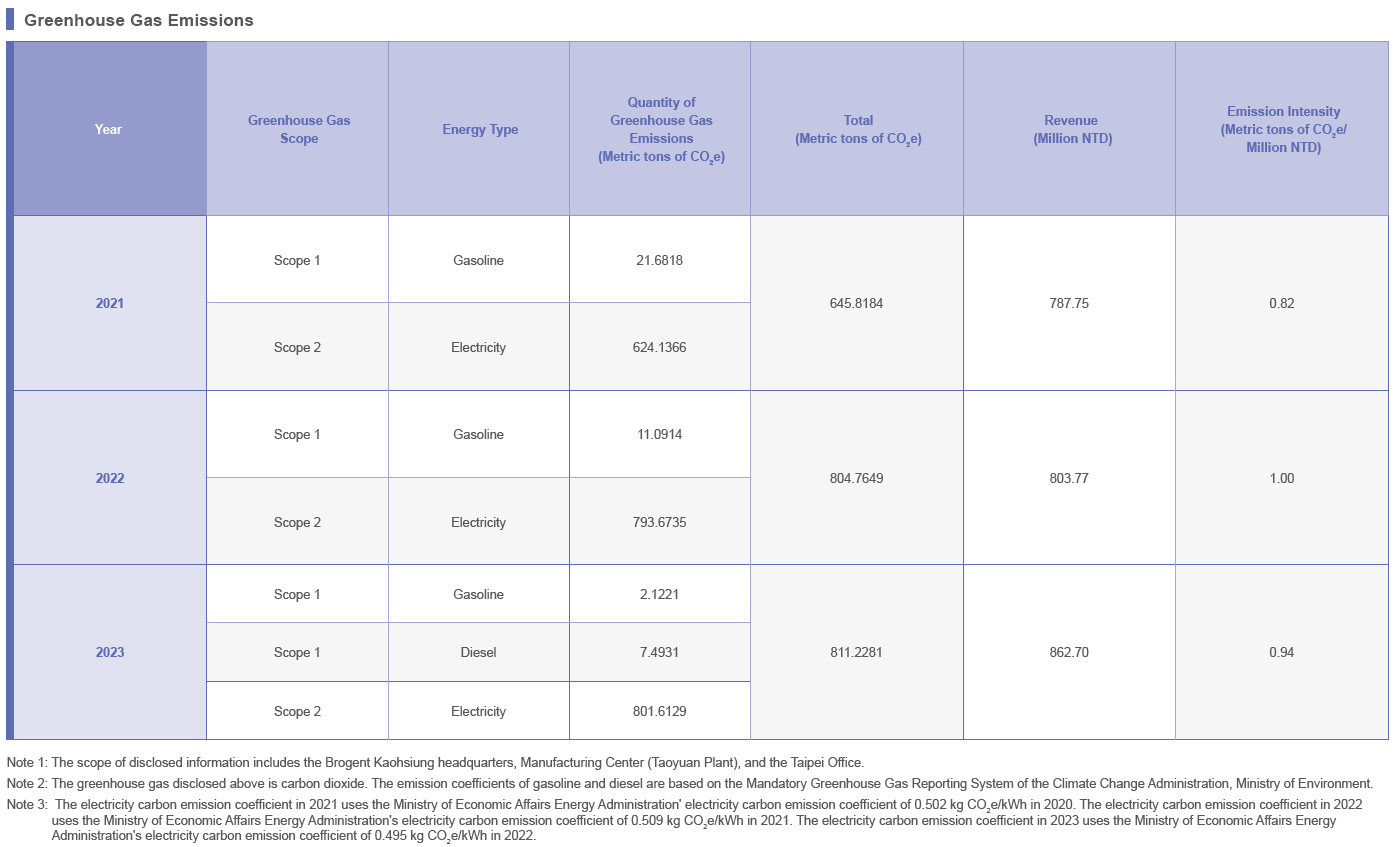

GHG emissions management

Brogent continues to improve the Company's system and conduct self-examinations, take energy-saving actions, support renewable energy power generation, and incorporate sustainable product thinking into R&D and design to achieve the goal of reducing GHG emissions by 0.25% annually. We also strengthened employees' awareness and management of climate change risks, and referenced version 6.0.4 of the Executive Yuan Ministry of Environment's GHG emission coefficient management chart each year, as well as the electricity carbon emission factor announced by the Ministry of Economic Affairs Energy Administration in the previous year. We estimated the Scope 1 and Scope 2 GHG emissions of Brogent's Kaohsiung Headquarters, the Manufacturing Center (Taoyuan Plant), and Taipei Office on this basis, and use it to track management results. Brogent's Scope 1 and Scope 2 GHG emissions in 2023 were 9.62 and 801.61 metric tons CO2e, respectively, totaling 811.23 metric tons CO2e, which is equal to 0.94 metric tons CO2e per million NTD of revenue.

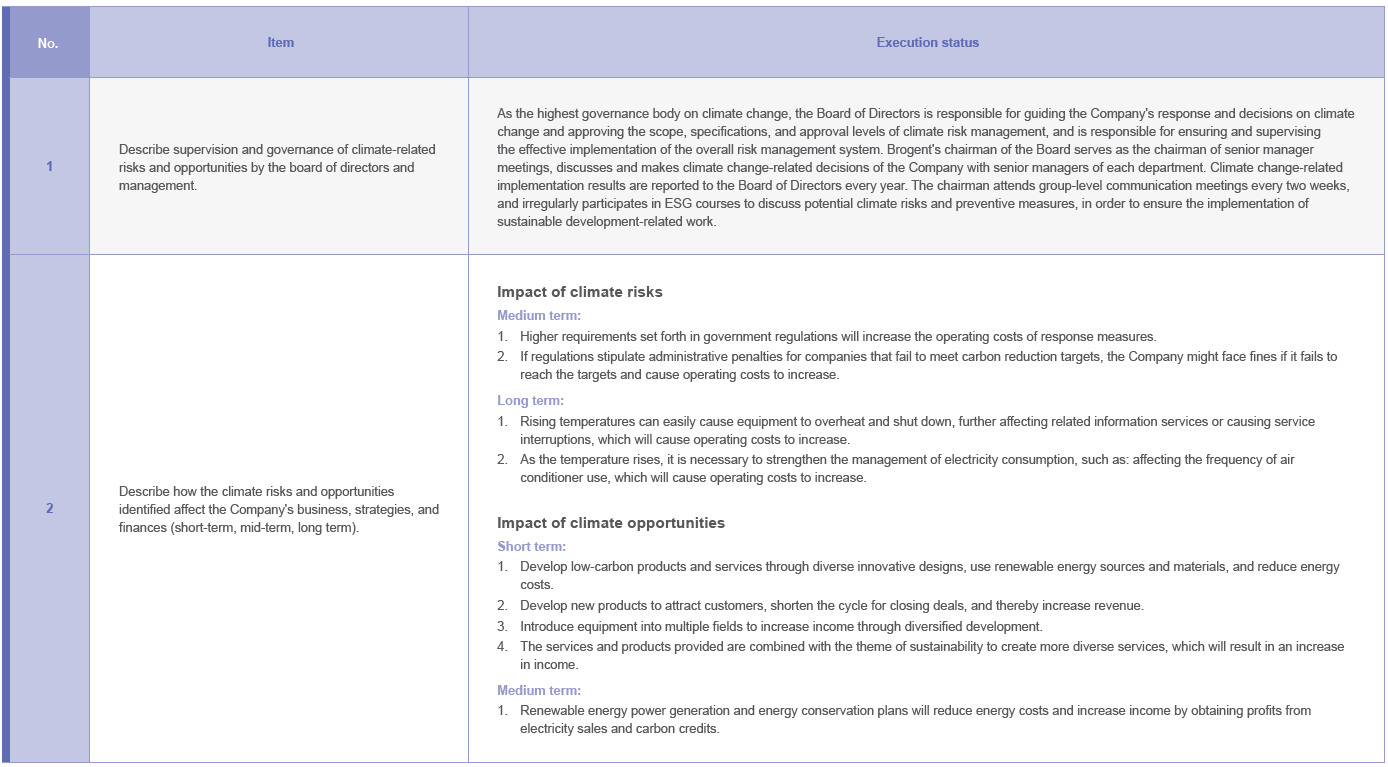

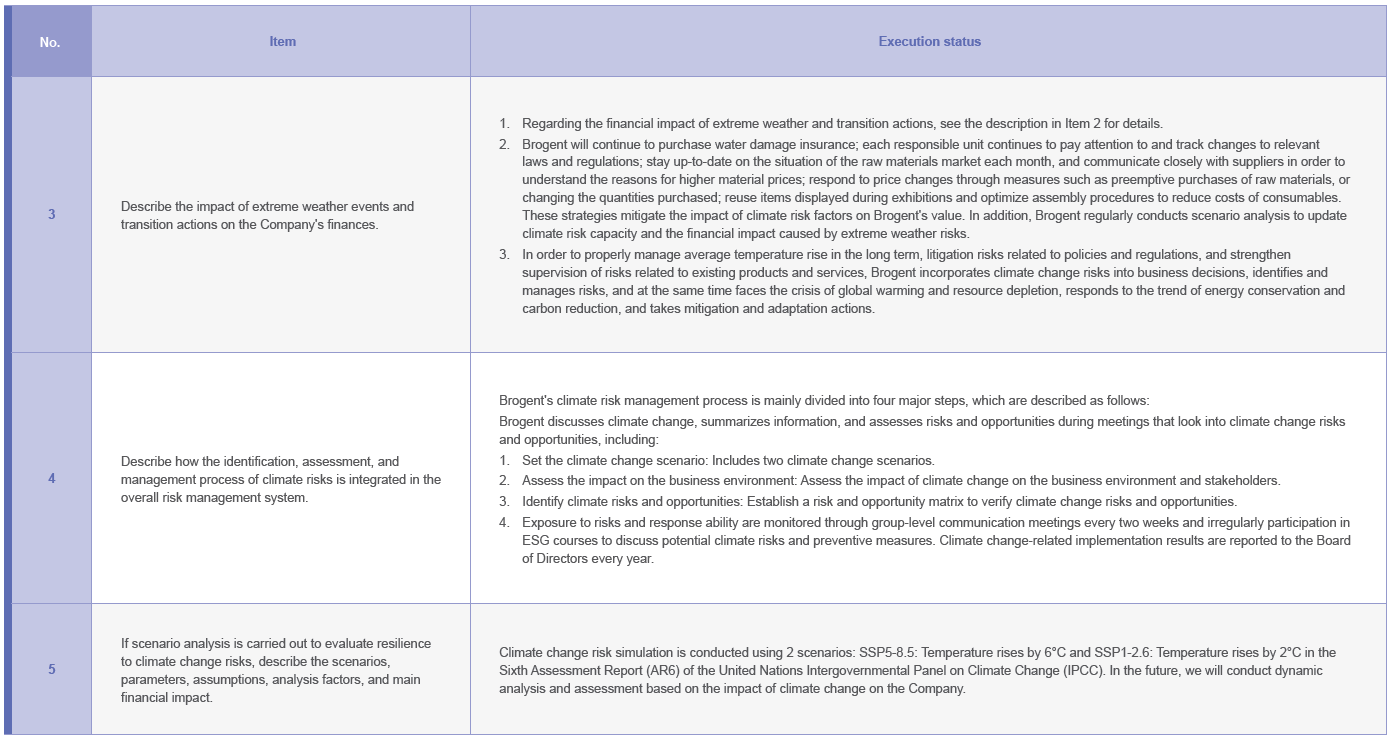

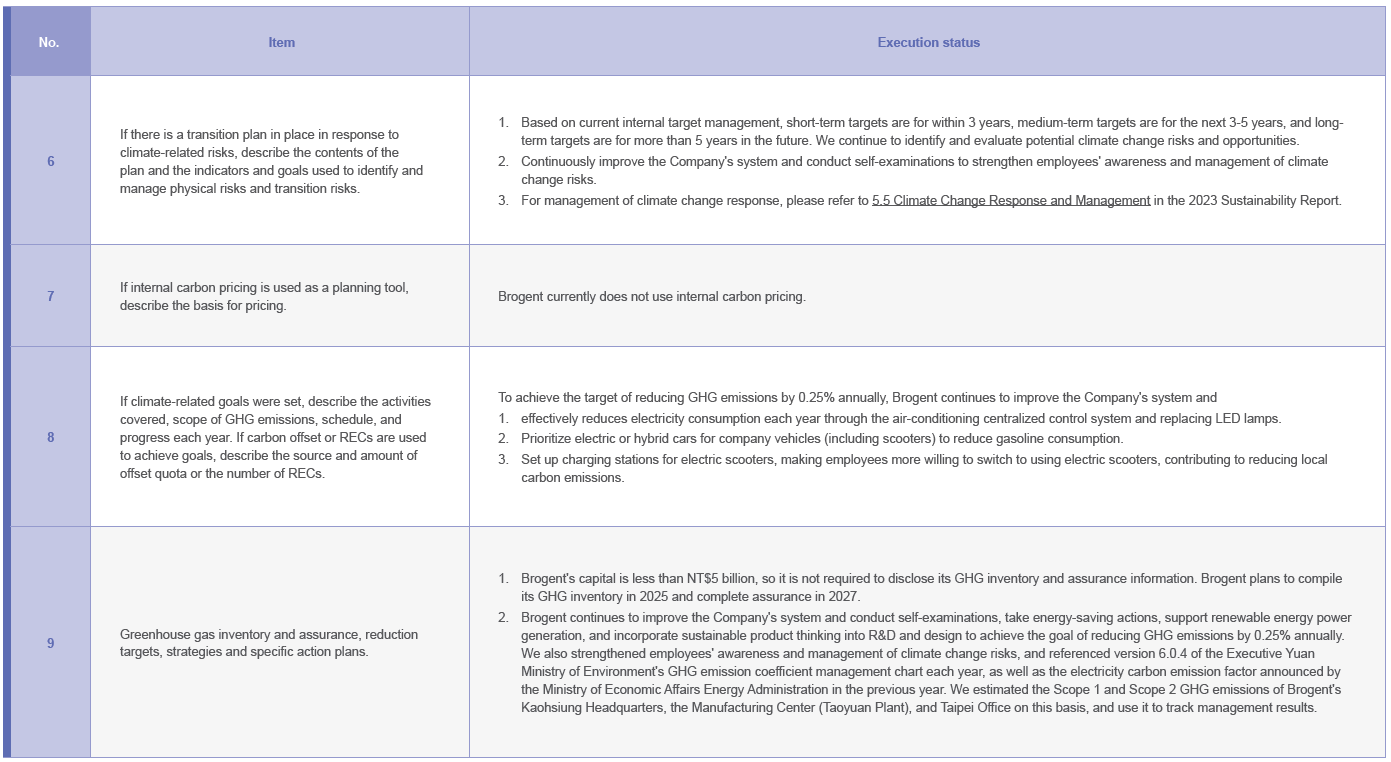

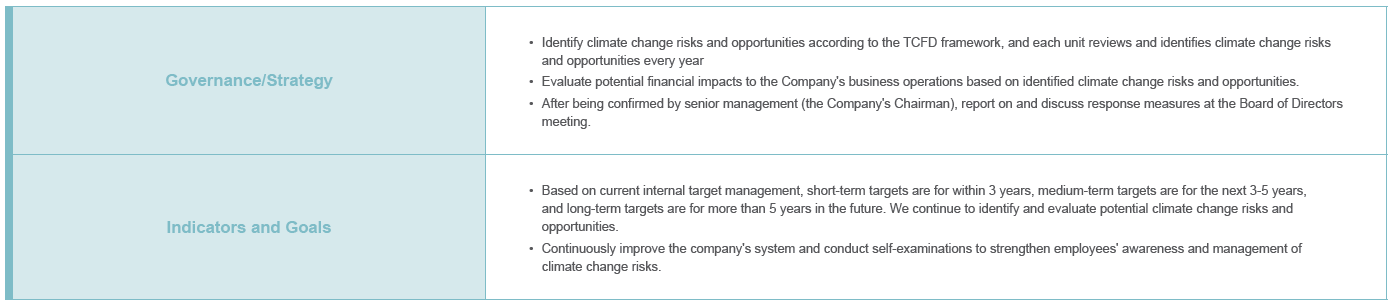

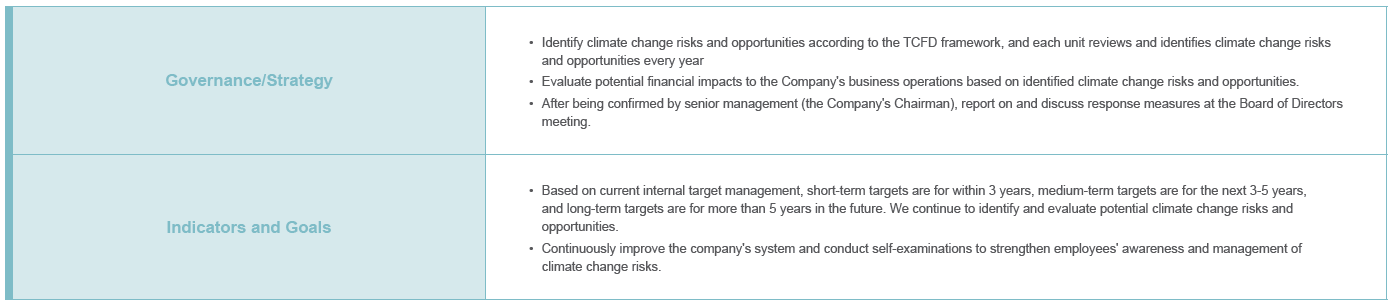

Comparison Table of Climate-related Disclosures

Risks and Opportunities Brought by Climate Change to the Company and Response Measures Taken by the Company

In light of potential financial risks to business operations due to climate change, disclosing information related to climate change has become relevant in sustainability information disclosure. Brogent has set the target to reduce GHG emissions by 0.25% each year, and identified climate-related risks and opportunities in accordance with the Task Force on Climate-related Financial Disclosures (TCFD) issued by the Financial Stability Board (FSB) and the Taiwan Stock Exchange Corporation Rules Governing the Preparation and Filing of Sustainability Reports by TWSE Listed Companies. Identification results are incorporated into the Company's overall risk management framework and serve as one of Brogent's sustainable development strategies.

Identification Process for Climate-related Risks and Opportunities

Brogent continues to pay attention to climate-related policies and action plans of various industries in Taiwan and overseas, and reviews and evaluates various risks and opportunities that may be caused by climate change for matrix analysis, including: direct or indirect physical effects of changes in rainfall and climate patterns; changes in market demand caused by new policies and regulations; risks and opportunities brought by social aspects to the Company's business activities. These efforts aim to reduce climate change risks, seize business opportunities, and implement the Company's sustainability philosophy.

Brogent discusses climate change, summarizes information, and assesses risks and opportunities during meetings that look into climate change risks and opportunities. The specific process for identifying climate change-related risks and opportunities is as follows:

After completing the identification of climate risks and opportunities, we identified three high-risk factors and three high-opportunity factors of Brogent in 2023 based on the "probability of occurrence" and "degree of impact" of the risks or opportunities. Brogent's climate change risk matrix and opportunity matrix in 2023 are as follows:

Description of Climate Change-related Risks

Description of Climate Change-related Opportunities

Response to and Management of Climate Change Risks

Integrate into regular risk management operations, establish specific improvement plans and risk indicators for each risk management item, preventing potential risks from posing a substantial or transitional impact to Brogent should they occur.

Response to and Management of Climate Change Opportunities

Identify opportunities that can allow Brogent to get ahead of the competition, helping us prepare the necessary investment or resource usage in advance to take advantage of these opportunities.

GHG emissions management

Brogent continues to improve the Company's system and conduct self-examinations, take energy-saving actions, support renewable energy power generation, and incorporate sustainable product thinking into R&D and design to achieve the goal of reducing GHG emissions by 0.25% annually. We also strengthened employees' awareness and management of climate change risks, and referenced version 6.0.4 of the Executive Yuan Ministry of Environment's GHG emission coefficient management chart each year, as well as the electricity carbon emission factor announced by the Ministry of Economic Affairs Energy Administration in the previous year. We estimated the Scope 1 and Scope 2 GHG emissions of Brogent's Kaohsiung Headquarters, the Manufacturing Center (Taoyuan Plant), and Taipei Office on this basis, and use it to track management results. Brogent's Scope 1 and Scope 2 GHG emissions in 2023 were 9.62 and 801.61 metric tons CO2e, respectively, totaling 811.23 metric tons CO2e, which is equal to 0.94 metric tons CO2e per million NTD of revenue.

Comparison Table of Climate-related Disclosures

Risks and Opportunities Brought by Climate Change to the Company and Response Measures Taken by the Company